When did globalisation start?

The Economist

"GLOBALISATION” has become the buzzword of the last two decades. The sudden increase in the exchange of knowledge, trade and capital around the world, driven by technological innovation, from the internet to shipping containers, thrust the term into the limelight.

Some see globalisation as a good thing. According to Amartya Sen, a Nobel-Prize winning economist, globalisation “has enriched the world scientifically and culturally, and benefited many people economically as well”. The United Nations has even predicted that the forces of globalisation may have the power to eradicate poverty in the 21st century.

Others disagree. Globalisation has been attacked by critics of free market economics, like the economists Joseph Stiglitz and Ha-Joon Chang, for perpetuating inequality in the world rather than reducing it. Some agree that they may have a point. The International Monetary Fund admitted in 2007 that inequality levels may have been increased by the introduction of new technology and the investment of foreign capital in developing countries. Others, in developed nations, distrust globalisation as well. They fear that it often allows employers to move jobs away to cheaper places. In France, "globalisation" and “delocalisation" have become derogatory terms for free market policies. An April 2012 survey by IFOP, a pollster, found that only 22% of French people thought globalisation a “good thing” for their country.

However, economic historians reckon the question of whether the benefits of globalisation outweigh the downsides is more complicated than this. For them, the answer depends on when you say the process of globalisation started. But why does it matter whether globalisation started 20, 200, or even 2,000 years ago? Their answer is that it is impossible to say how much of a “good thing” a process is in history without first defining for how long it has been going on.

Early economists would certainly have been familiar with the general concept that markets and people around the world were becoming more integrated over time. Although Adam Smith himself never used the word, globalisation is a key theme in the Wealth of Nations. His description of economic development has as its underlying principle the integration of markets over time. As the division of labour enables output to expand, the search for specialisation expands trade, and gradually, brings communities from disparate parts of the world together. The trend is nearly as old as civilisation. Primitive divisions of labour, between “hunters” and “shepherds”, grew as villages and trading networks expanded to include wider specialisations. Eventually armourers to craft bows and arrows, carpenters to build houses, and seamstress to make clothing all appeared as specialist artisans, trading their wares for food produced by the hunters and shepherds. As villages, towns, countries and continents started trading goods that they were efficient at making for ones they were not, markets became more integrated, as specialisation and trade increased. This process that Smith describes starts to sound rather like “globalisation”, even if it was more limited in geographical area than what most people think of the term today.

Smith had a particular example in mind when he talked about market integration between continents: Europe and America. The discovery of Native Americans by European traders enabled a new division of labour between the two continents. He mentions as an example, that the native Americans, who specialised in hunting, traded animal skins for “blankets, fire-arms, and brandy” made thousands of miles away in the old world.

Some modern economic historians dispute Smith’s argument that the discovery of the Americas, by Christopher Columbus in 1492, accelerated the process of globalisation. Kevin O’Rourke and Jeffrey Williamson argued in a 2002 paper that globalisation only really began in the nineteenth century when a sudden drop in transport costs allowed the prices of commodities in Europe and Asia to converge. Columbus' discovery of America and Vasco Da Gama’s discovery of the route to Asia around the Cape of Good Hope had very little impact on commodity prices, they argue.

But there is one important market that Mssrs O’Rourke and Williamson ignore in their analysis: that for silver. As European currencies were generally based on the value of silver, any change in its value would have had big effects on the European price level. Smith himself argued this was one of the greatest economic changes that resulted from the discovery of the Americas:

The discovery of the abundant mines of America, reduced, in the sixteenth century, the value of gold and silver in Europe to about a third of what it had been before. As it cost less labour to bring those metals from the mine to the market, so, when they were brought thither, they could purchase or command less labour; and this revolution in their value, though perhaps the greatest, is by no means the only one of which history gives some account.

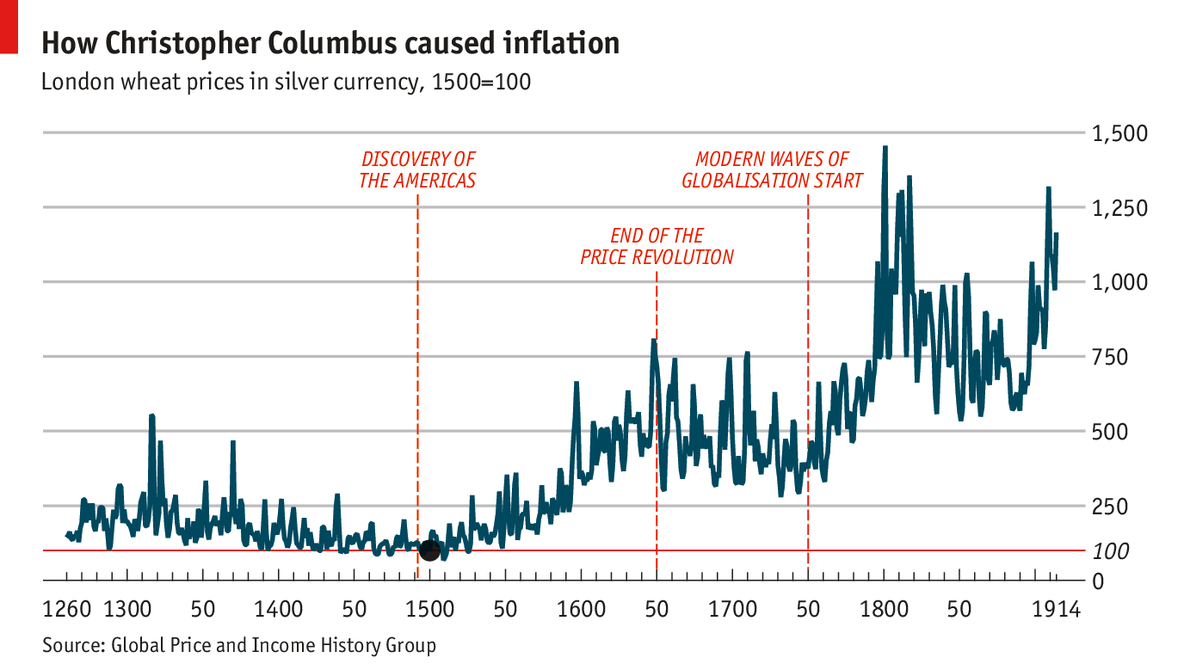

The influx of about 150,000 tonnes of silver from Mexico and Bolivia by the Spanish and Portuguese Empires after 1500 reversed the downwards price trends of the medieval period. Instead, prices rose dramatically in Europe by a factor of six or seven times over the next 150 years as more silver chased the same amount of goods in Europe (see chart).

The impact of what historians have called the resulting “price revolution” dramatically changed the face of Europe. Historians attribute everything from the dominance of the Spanish Empire in Europe to the sudden increase in witch hunts around the sixteenth century to the destabilising effects of inflation on European society. And if it were not for the sudden increase of silver imports from Europe to China and India during this period, European inflation would have been much worse than it was. Price rises only stopped in about 1650 when the price of silver coinage in Europe fell to such a low level that it was no longer profitable to import it from the Americas.

The rapid convergence of the silver market in early modern period is only one example of “globalisation”, some historians argue. The German historical economist, Andre Gunder Frank, has argued that the start of globalisation can be traced back to the growth of trade and market integration between the Sumer and Indus civilisations of the third millennium BC. Trade links between China and Europe first grew during the Hellenistic Age, with further increases in global market convergence occuring when transport costs dropped in the sixteenth century and more rapidly in the modern era of globalisation, which Mssrs O’Rourke and Williamson describe as after 1750. Global historians such as Tony Hopkins and Christopher Bayly have also stressed the importance of the exchange of not only trade but also ideas and knowledge during periods of pre-modern globalisation.

Globalisation has not always been a one-way process. There is evidence that there was also market disintegration (or deglobalisation) in periods as varied as the Dark Ages, the seventeenth century, and the interwar period in the twentieth. And there is some evidence that globalisation has retreated in the current crisis since 2007. But it is clear that globalisation is not simply a process that started in the last two decades or even the last two centuries. It has a history that stretches thousands of years, starting with Smith’s primitive hunter-gatherers trading with the next village, and eventually developing into the globally interconnected societies of today. Whether you think globalisation is a “good thing” or not, it appears to be an essential element of the economic history of mankind.

Suggested Reading:

Alvey, J. E. (2003). 'Adam Smith’s Globalization (but anti-Secularization) theory'. Massey University, Department of Applied and International Economics Discussion Papers.

Bateman, V. N. (2012). Markets and Growth in Early Modern Europe. Pickering & Chatto.

Bayly, C. A. (2004) The Birth of the Modern World 1780-1914: Global Connections and Comparisons. Blackwell.

Fisher, D. (1989) 'The Price Revolution: A Monetary Interpretation'. The Journal of Economic History, 49(4), 883-902.

Hopkins, A. G. (ed.). (2002). Globalization in World History. W. W. Norton.

O’Rourke, K. H., and Williamson, J. G. (1999). Globalisation and History: The Evolution of a Nineteenth-century Atlantic Economy. MIT Press.

O’Rourke, K. H., and Williamson, J. G. (2002). ‘When did globalisation begin?’. European Review of Economic History, 6(1), 23-50.

No hay comentarios:

Publicar un comentario